Just because you pay a lot for a watch does not mean that it will sell at a later time for the same or more.

It all depends on the watch.

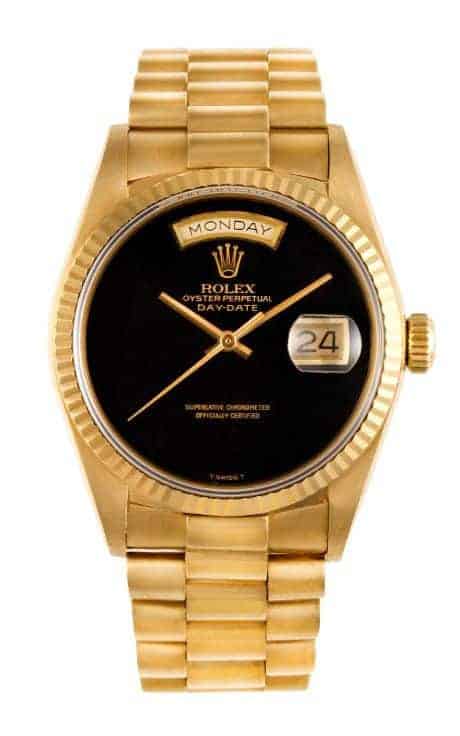

High end watches typically hold their value better than most other investments even in a recession, and certain modern watches can appreciate in value as much as 30% over years. Sometimes it can take a few decades for a watch to accrue in significant value however. Today, the most valuable watches on the re-sale market are vintage watches made before 1980. There are still many reasons why some watches hold their value and some do not. Its not just the gold watches that hold their value, some stainless steel watches have generated hundreds of thousands of dollars at auction.

A rare timepiece will bring a higher return when re-sold which is true of just about everything, especially art and jewelry. It’s the simple concept of supply and demand. If only a handful of a particular watch were made, naturally, it will create a buzz globally and a high price will surely be had.

A one-of-a-kind gold Rolex Cosmograph Daytona watch with black dial sold at auction for $5.9 million because it was believed to the only one known of its kind.

Limited edition watches are also coveted because of the reduced amount of pieces in circulation.

There is no doubt that certain brand names retain their values better than others. Most are the luxury Swiss watch brands including Patek Philippe, Rolex, Audemars Piguet, Vacheron Constantin, and Cartier. Within the brands, certain models are more sought-after than others. For instance, a Cartier watch can range from $2500.00 to millions so there is a massive range of price. The good news is that there is a watch for every one and every price range.